The Future of Sports Gambling in America: By the Numbers

Assigning SCOTUS probabilities across certiorari, questions presented, and the eventual outcome

The idea for this post came from a commenter who posed us this question upon reading Kalshi’s Gambit: The Bet That Could Break Sports Gambling:

If you had to assign odds...how would you estimate them across outcomes? Very interesting read!

That got us thinking. The result is this post.

Predicting whether the Supreme Court will grant certiorari is notoriously difficult. Beyond our own forecast, it’s important to note that the Court accepts only about 2% of the petitions it receives. It typically agrees to hear a case only under narrow circumstances–most often when there is a significant federal question at stake, a split among the circuit courts on a point of law or a matter of exceptional national importance. Sports gambling happens to be an issue that checks all these boxes.

Getting to be heard is one challenge and then what exactly will get heard and what the outcome will be are difficult questions in and of themselves. When we started to discuss these issues internally, and shared our guesses with each other, we realized we had a variance in opinion. We agreed on the three-point framework below, but we ended up assigning different probabilities to potential outcomes. Rather than presenting our averages, in the interest of full disclosure, we decided to share our individual estimates and commentary with you.

Agree? Disagree? Either way, let us know. The future of sports gambling in America is what’s at stake and dialogue is healthy.

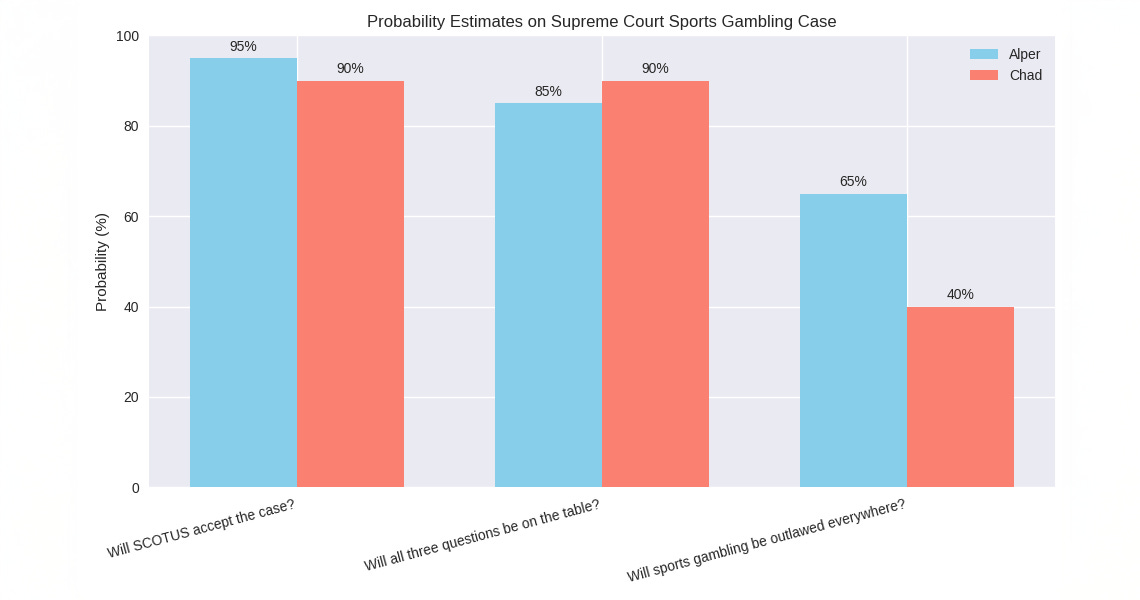

Will SCOTUS accept the case?

We believe this is extremely likely. The issue is a foundational federal vs. state struggle wrapped into one of the most significant social vices known to mankind: Sports gambling. Circuit splits are currently developing. During the nomination hearing yesterday, Michael Selig signaled that he will defer to the courts. That’s a setup that will be difficult for the Supreme Court to pass up.

Alper Odds: 95%, Chad Odds: 90%

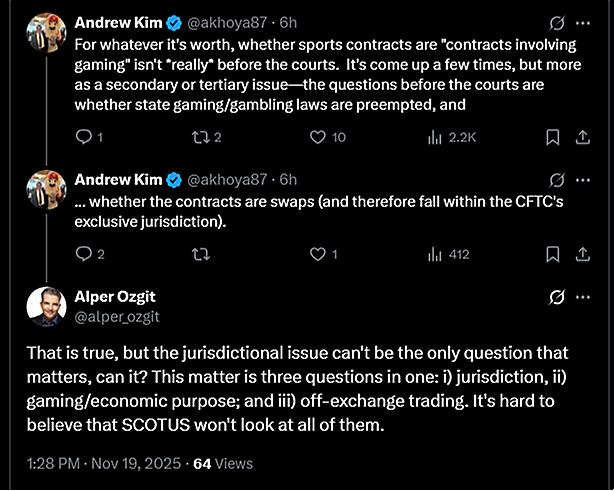

Will all three questions be on the table (jurisdiction, gaming/economic purpose, off-exchange futures trading)?

There is always a chance that SCOTUS evaluates a narrower issue (e.g. preemption only), but in our view, the jurisdiction question is where it starts not where it ends. Consider the below exchange on X we had with Andrew Kim:

An APA challenge is most likely going to be the most successful route for exploring all three questions. Regardless, we do believe SCOTUS will explore all three.

Alper Odds: 85%, Chad Odds: 90%

Will sports gambling be outlawed everywhere?

A pure legal analysis leads to the natural conclusion that all sports gambling is prohibited, everywhere. There is always a chance, of course, that the Supreme Court will disagree, or, the incentives involved in politics will play a role. The future of sports gambling in America is what’s at stake after all. Our most material variance was here. Alper believes that SCOTUS will follow where the law leads. Chad believes it will be a closer call, predicting that the state regime is slightly more likely than sports gambling being swept off the table altogether.

Alper Odds: 65%, Chad Odds: 40%

These three events may not be fully independent, but assuming they are, multiplying these three odds using Alper’s estimates gives us a slightly more than even odds-a 52% chance that a SCOTUS ruling will lead to the demise of the entire sports gambling industry, both at the federal and state level. Under Chad’s analysis, there’s roughly a 32% chance that the entire sports gambling industry is taken down on the federal and state level.

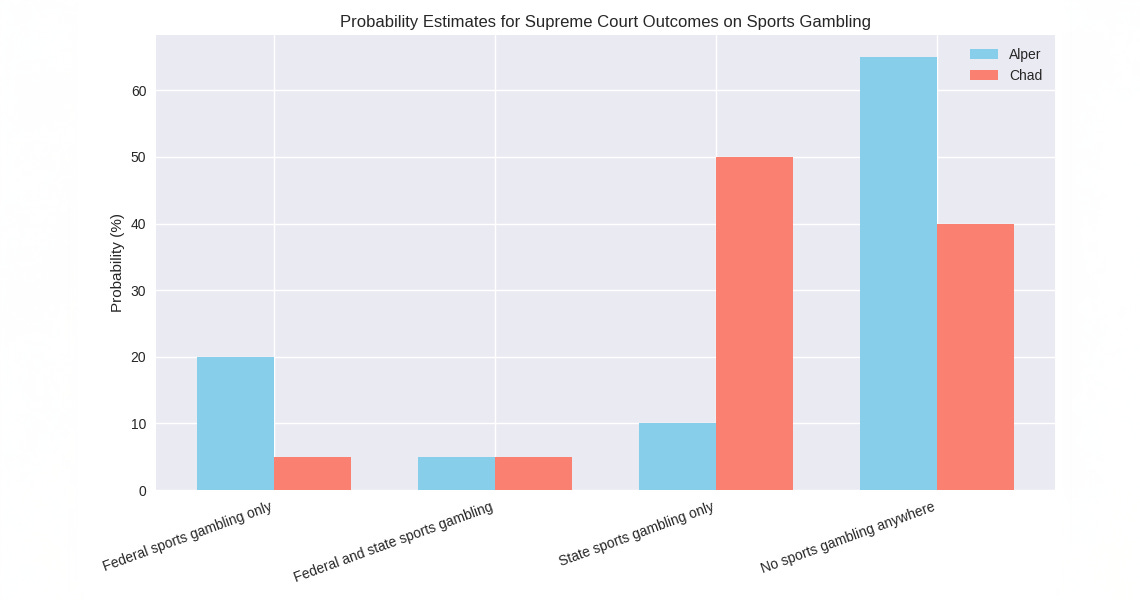

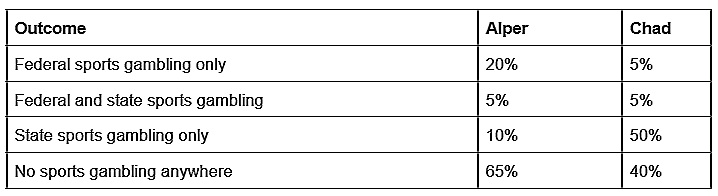

Let’s unpack. Assuming SCOTUS takes the case, and all three questions are on the table, there are four possible outcomes:

i) Sports gambling is ok but at the federal level only

ii) Sports gambling is ok at both federal and state level

iii) Sports gambling is ok but at the state level only

iv) Sports gambling is not ok at the federal or state level

i) Means prediction markets are allowed at the federal level and state-regulated sports gambling is out. Looks like DraftKings and FanDuel are expecting this as a realistic scenario and hedging, as it was just announced that both companies are resigning from the AGA.

ii) Means anything goes. America becomes a sports gambling mecca with two different regimes co-existing.

iii) Means that we roughly go back to what we have now with states (and maybe tribes) calling the shots. Kalshi, Polymarket and other prediction market-only plays may survive, but largely become election market outfits that spike in popularity every four years (assuming those markets themselves survive the challenge). Others that dabble in this space, like CME, go back to their normal business operations.

iv) Is where the most radical change occurs. It means that the third gambling wave in America is finished. Sports gamblers go back to the casinos and traders go back to the stock market and crypto exchanges, until the next push comes.

Here are our individual probability estimates on each:

ALPER: I am bullish on iv). Why? Because off-exchange limitations are real, and I find it really hard to contemplate a scenario where state-regulated sports gambling survives regardless of what happens on the federal side. But perhaps a state-only scenario is a little more likely than the “anything goes” scenario, if SCOTUS is hesitant to abolish the entire industry. In any event, politics, influence and power will likely push for i) not for ii) and iii), which makes it a higher-probability event compared to ii) or iii).1 So the real showdown is between i) and iv). Between those two, I continue to believe that SCOTUS will go where the law leads, and that legal analysis will trump legal realism.

CHAD: In contrast, I assign a much higher probability of 50% to the state-only scenario. I believe that based on the current administration’s patterns and directives, we could see the sports gambling industry shift to the states, similar to what happened with DFS (in regards to how it is regulated). However, this is primarily based upon the incentivization surrounding the political environment as it is right now. Should the future of the current administration and/or the Supreme Court’s political casting swing back to the other side of the aisle, then the percentage chance that sports gambling is outlawed everywhere could jump greatly, with some outside chance remaining that the nation goes back to the previous status quo with Nevada being the only place to wager on sports. As it is generally known, subjects of this magnitude can take years to wind up and unfurl, so that is a serious consideration.

If a SCOTUS ruling results in sports gambling being taken down entirely, will that be the end of the story? Of course not. Again, there is too much at stake. The moment SCOTUS accepts the case, the industry will kick into high gear and begin lobbying Congress (if they haven’t been already), hedging against the worst outcome.

The public is skeptical — only 7% of Americans view legal sports betting as good for society — but sentiment alone rarely dictates the law. The Supreme Court’s eventual ruling will hinge on statutory interpretation and constitutional boundaries, yet whatever the Court decides will immediately collide with powerful economic incentives and perhaps state-level interests. Even if the judiciary leans toward prohibition, the gambling industry’s lobbying power and the fiscal realities facing governments make outright elimination difficult to sustain. And beyond gambling itself, the future may hold alternative models — frameworks that treat sports not as wagers but as investable assets, reshaping how fans and markets engage. In the end, the odds will be shaped not just in the courtroom, but in the political economy that surrounds it — where doctrine, dollars, and public opinion all intersect to determine the future of sports gambling in America.

Alternatively, if SCOTUS remains silent on the matter of off-exchange trading, post-SCOTUS litigation will likely eradicate state-regulated sports gambling anyway (more reason for SCOTUS to take up all three questions, and not just the jurisdictional issue).

Thank you for the follow up piece! It is startling how high the scenario 4 probabilities are, it seems like a complete black swan outcome